Alternative investments can pave the way to a stable future

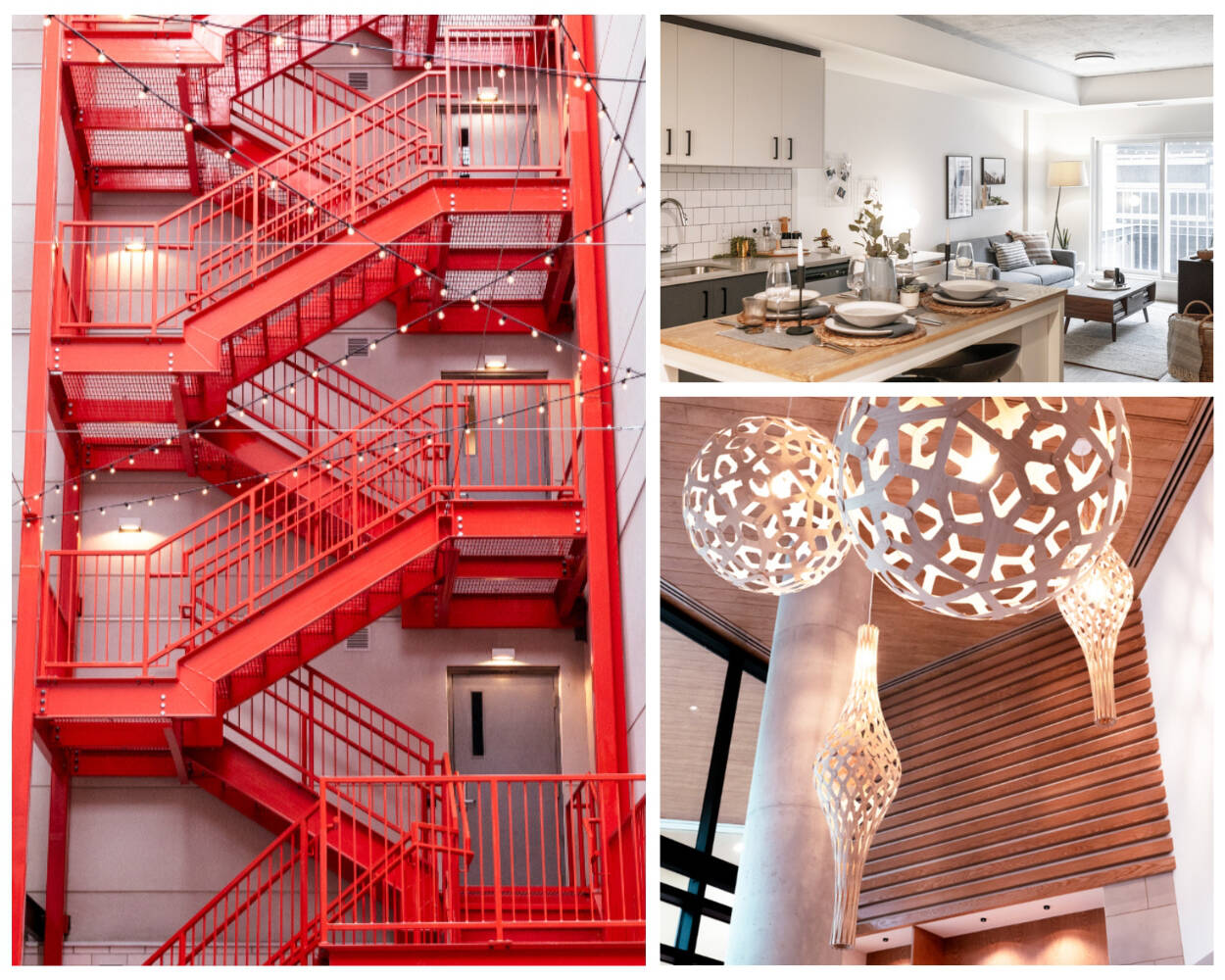

Alitis portfolio manager, Harrison Brown (left) with Autograph president, Henry Edgar (right) in the lobby of Mercury Block, one of Alitis’s multi-family dwellings in Alberta.

“Alternative investments often get a bad rap but in reality they’re just another tool in the toolbox and often act as a safe harbour during unpredictable storms that occasionally accompany traditional investments,” says Alitis Investment Counsel’s Chief Investment Officer, Kevin Kirkwood. “Utilizing alternative investments alongside traditional investments is prudent portfolio management.”

Those in the financial world know 2022 was a tough year for investors, with many accepting notable hits to their returns as simply ‘part of the risk,’ but Alitis Investment Counsel clients had a slightly different experience. While many traditional investments lost money in 2022, Alitis still provided most of their clients with a positive return that year. A notable feat considering the rocky financial environment they were working with.

“2022 was a great example of how alternative investments helped provide a more stable investment portfolio,” Kirkwood says. “That year they provided a safer and more predictable return and often provide another layer of protection during these ‘worst case’ scenarios.”

Alitis utilizes a variety of alternative investments along with more traditional options like stocks and bonds to create a diverse and well-structured portfolio for their clients. This approach has allowed them to weather many storms over the years and provide clients with the confidence that their investments are well protected.

“One of our preferred forms of alternative investments is real estate, and Alitis funds hold a number of multi-family dwellings in British Columbia, Alberta, and Manitoba. These rental properties have acted as a stable investment for our clients because as we all know, housing is in high demand across the country,” Kirkwood says. “Real estate is also easy to explain to people. The apartment building generates income from rent and other fees, which leads to a reasonably predictable investment.”

Alitis’ unique approach in balancing traditional with alternative investments is one of the many reasons their services are in demand. While large brokerages often limit their use of alternative investments in favour of more traditional approaches, Alitis has seen first-hand the benefit of balancing the two.

“Many of our alternative investments are about the long game,” Kirkwood explains. “Our use of alternative investment opportunities reflects how we regard our clients’ money. Our primary goal is not to make a quick buck, but instead to moderate risk to the best of our ability to provide a smoother investment journey for our clients.”

Is the Alitis Approach right for you? Call 250-287-4933 or email info@alitis.ca to learn more. Find them in Campbell River at 101-909 Island Highway, the Comox Valley at 103-695 Aspen Rd., in Victoria at 1480 Fort St., or online at alitis.ca.

READ MORE from Alitis:

Alitis Private Mortgage Fund celebrates 10 years of growth

Investing for the future: Real estate’s potential in a growing Canada

Time on the market beats timing the market